Investments

Browse fund performance and objectives

Resources

Log in and manage your account

Investments

Fund search

Explore our broad suite of alternative investment solutions

Alternative investment structures + offerings

Access alternatives through diverse investment structures and offerings.

Alternative asset classes + strategies

Explore the broad universe of investment options to help meet your financial goals.

Listen to the FireSide podcast

Tune in for timely, thoughtful analysis from our alternative investment experts.

Meet Executive Director of Investment Research Andrew Korz

In-depth analyses on equity markets, U.S. commercial real estate, and more.

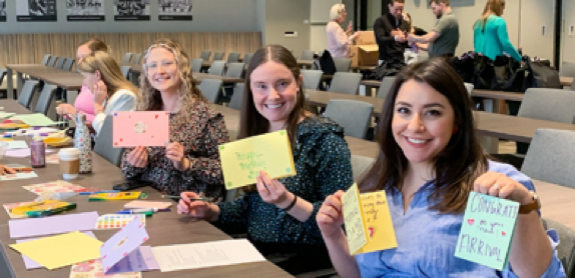

Learn how FS Investments supports our colleagues and gives back to the community.

Learn how FS Investments supports our colleagues and gives back to the community. Are you looking to advance your career? Explore how you can reach your goals at FS Investments.

Are you looking to advance your career? Explore how you can reach your goals at FS Investments.